Ignoring your credit score could bring you against unbearable costs. Have a look at the consequences that result from overlooking regular credit score review.

Doctor Life Insurance

visualized by: AAFP Insurance

As a doctor you put so much effort and will on keeping your fellows safe from harm. But how you deal with insecurity and financial unsafety due to life contingencies? Life insurance is an idea you should start thinking of for you own and family good. Learn why that.

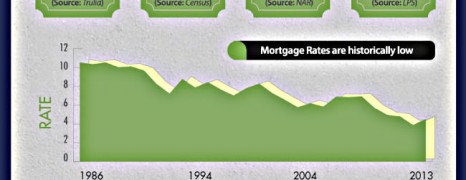

Buyers or Renters US Market

visualized by: Elika Real Estate

Are you more into buying or renting a home? This report presents the pros and cons of these 2 options together with some statistics and US from the US real estate market for the last 3 years.

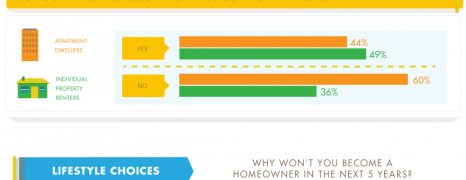

Rent is the Trend

visualized by: Appfolio

This report examines the shift in the US real estate market both for individual properties and apartments. According to recent surveys renters refrain from becoming homeowners and realtors see no good projections for getting them buy. Mortgage eligibility doesn’t seem to be the major cause.

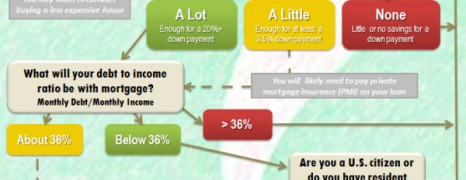

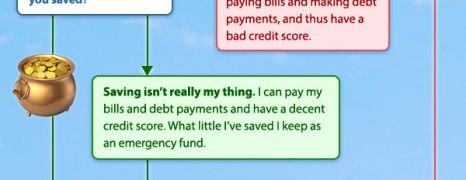

Mortgage Qualification Guide

visualized by: RealEstate.com

Mortgage loans are used by the vast majority of home buyers to finance the purchase of their homes. However, some of them do not fulfill the criteria for loan accreditation due to various factors such as low credit scores, high debt to income ratios and uninspiring employment background. This flowchart will help you weigh up the odds of getting a loan.

American Spending Trends

visualized by: CreditLoan.com

The average American is over $8,000 in debt, which is up dramatically from a whopping $48 in the 1940s! See a breakdown of Americans’ average monthly spending across the various product and service categories and get an idea of the average debt burden due to uncovered overspending.

Boost Credit Score Quickly

visualized by: Neo Mammalian Studios

Credit score evaluation is a key factor before getting qualified for certain types of transactions. Open doors to better financial deals by following 10 tips to boosting your credit score.

Do Before Buying House

visualized by: RealEstate.com

Are you one step before putting down roots? You better think it twice, as owning a house entails serious responsibilities and commitments. The buying decision should encapsulate firm answers to a series of questions that this flow chart brings to the front. Are you ready?

Credit Crisis Simplified

visualized by: Jonathan Jarvis

For you people that you experience and feel the downturn resulting from the so called credit crisis, here is the simplified version of what happens in the mortgage market and how brokers, banks and investment institutions are creating financial bombs. Creativity in its excellence-this presentation wins an A+ grade.

Living Without Mortgage

visualized by: Beckon Media

The concept for this infographic is to show the positive financial impact of living without your mortgage for a year. You will see the major causes of consumer debt as well as price in working hours needed to pay off each debt.

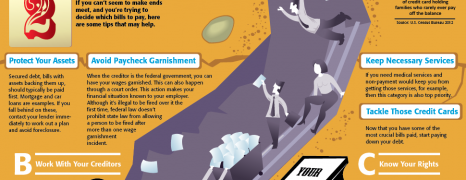

Dig Yourself Out Of Debt

visualized by: Credit Donkey

Are you wobbling with your personal finance? Read this helpful guide and start reconciling before going down the drain.

Generations’ Credit Profile

visualized by: Experian

Generations seem to share on more gap. The credit gap! That is the differences in debt source and debt volume determined by their life-phase needs and wills.

How Interest Rates Work

visualized by: Kiboo

Self explanatory. À handy guide on banking finance simplified for non economists.

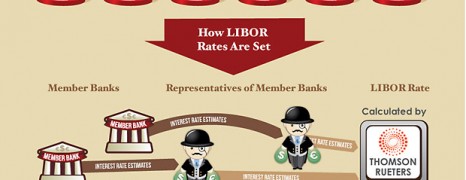

Libor Scandal for Dummies

visualized by: AccountingDegree.net

Is this a conspiracy theory, an unveiled truth or simply a global lift? The banking circuit that pumped even more wealth from the folk for the rich minorities, put on a simple chart for non-economists.